What You Should Know About Electrical Contractor Insurance

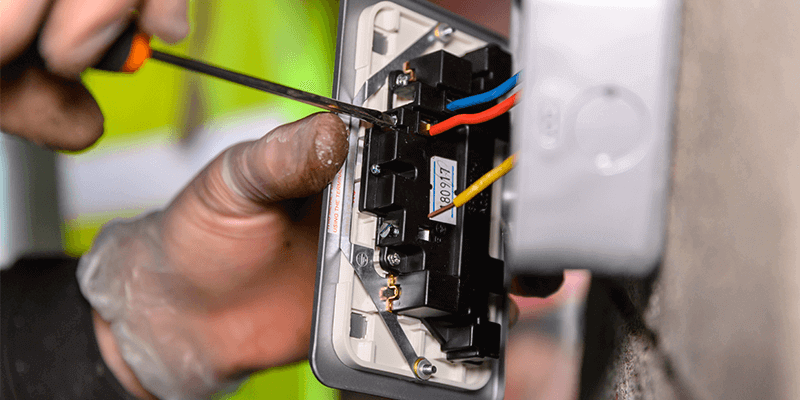

Running an electrical contracting business means you could face some hazards. Besides following consumer and licensing standards, you should safeguard your company against lawsuits and accidents involving your business.

Sparks may fly in your field of work if you make a mistake or have an accident. Electrical contractor insurance could help to reduce the impact of your risks.

So, what kind of business insurance do you need, and what does it cover? Read on to learn more about insurance for electrical contractors and how it may help you in the future.

Types of Electrical Contractor Insurance

Electrical contractors typically carry a handful of different policies. This is due to the number of risks an electrician can face, whether it concerns themselves or someone else. Most of the time, the following insurance policies may meet your needs:

General Liability Insurance

Every electrician should carry a general liability insurance policy for electrical contractors. Whether you work alone or as part of a large company, this is a general rule. This insurance is for third-party property damage or injury to someone other than an employee.

Electrical contractor liability insurance coverage is critical when you think about the nature of the job. Say you were to cause harm as an electrician, the responsibility for these issues could fall on you and may devastate your business.

General liability insurance might help if a third party interacts with your company and gets harmed or has property damage. The costs and legal fees associated with the third-party claim might have coverage under this policy.

Business Property Insurance

As an electrician, you might need expensive equipment for your job, such as pricey wiring and hand tools. A business property policy may assist in covering these costs if the equipment gets stolen or damaged in the event of a covered loss.

Equipment rented or owned by your company that needs repairing or replacing may be covered by business property insurance. If your company can not function at its full potential due to a loss, it may be able to offer your company payroll and operating expenses. This policy can help you offset lost profits for your company.

Cyber Insurance

Do you know about cyber insurance? Cyber insurance could help to cover costs to hire a professional to determine the extent of data recovery due to a cyber-attack. It may also help cover expenses related to customer notifications and legal fees that your company encounters as a result of the attack.

Consider a Business Owners Policy

Do you want general liability, business property, and cyber coverage? All three types of insurance are bundled in a Business Owners Policy, or BOP, from PolicySweet®.

Compared to purchasing three individual policies, it can be more affordable, practical, and manageable. A BOP includes general liability coverage, a business property policy, and cyber insurance to help cover costs of unexpected events.

Other Types of Insurance to Consider

There are several other types of insurance you may want to consider for your business. If you are worried about employee injuries, you may want to think about Workers’ Compensation coverage. It can help provide coverage for workplace accidents.

Workers' Compensation

You may end up responsible for expenses if an employee gets hurt or becomes ill as a result of working conditions. The costs connected with an employee's work-related illness or accident might have coverage under a Workers' Compensation policy.

If someone gets hurt while working for your business, Workers' Compensation insurance may cover the costs of their medical care and lost wages. Many states require that every company with employees buy a Workers' Compensation policy.

It is still a smart move to buy this insurance policy even if your state does not require it. Without it, you could be liable for medical bills and disability compensation for your workers.

Workers' Compensation may cover missed wages and accidents or injuries. It may cover medical expenses, illness, and disability. And it can help keep you in compliance with state laws.

A Few Examples of Claims Against Electrical Contractors

If you are fortunate, it may never happen to you. However, this is wishful thinking.

Claims against electrical contractors are more common than you may think. Here are a couple of examples of claims that you could end up facing:

General Liability for Property Damage

A homebuilder hires your electrical contracting company to install the electrical in a new custom home. When the installation is finished and tested, you have the homebuilder approve the work. Then, you and your team move on to the next project.

While conducting business in the custom home, you drop an expensive chandelier. In addition to the light fixture being damaged, it caused injuries to two bystanders. The destroyed property and medical expenses associated with the incident may have coverage under a general liability policy that could help cover bodily injury and property damage.

Workers' Compensation for an Employee That Fell off a Ladder

An employee falls down a step ladder while adjusting the wiring for a light fixture. The worker reaches out their arm to brace themselves, breaking it and injuring their wrist.

Later, it is determined that the employee will need surgery for their arm, with a recuperation time of about a month. Your injured employee's medical expenses may have coverage under your Workers' Compensation. They could receive reimbursement for some of their missed income as they recover and are off the job.

Covering Your Electrical Contracting Company Is Serious Business

You want your coverage to keep you firmly in place. When it comes to insurance for your electrical contracting business, you do not want to leave anything out. At PolicySweet, we can help you determine the best electrical contractor insurance for your electrical business needs.

Each insurance policy we create has your needs in mind, from general liability to Workers' Compensation. Contact us, or check out our blog for helpful information and guidance.